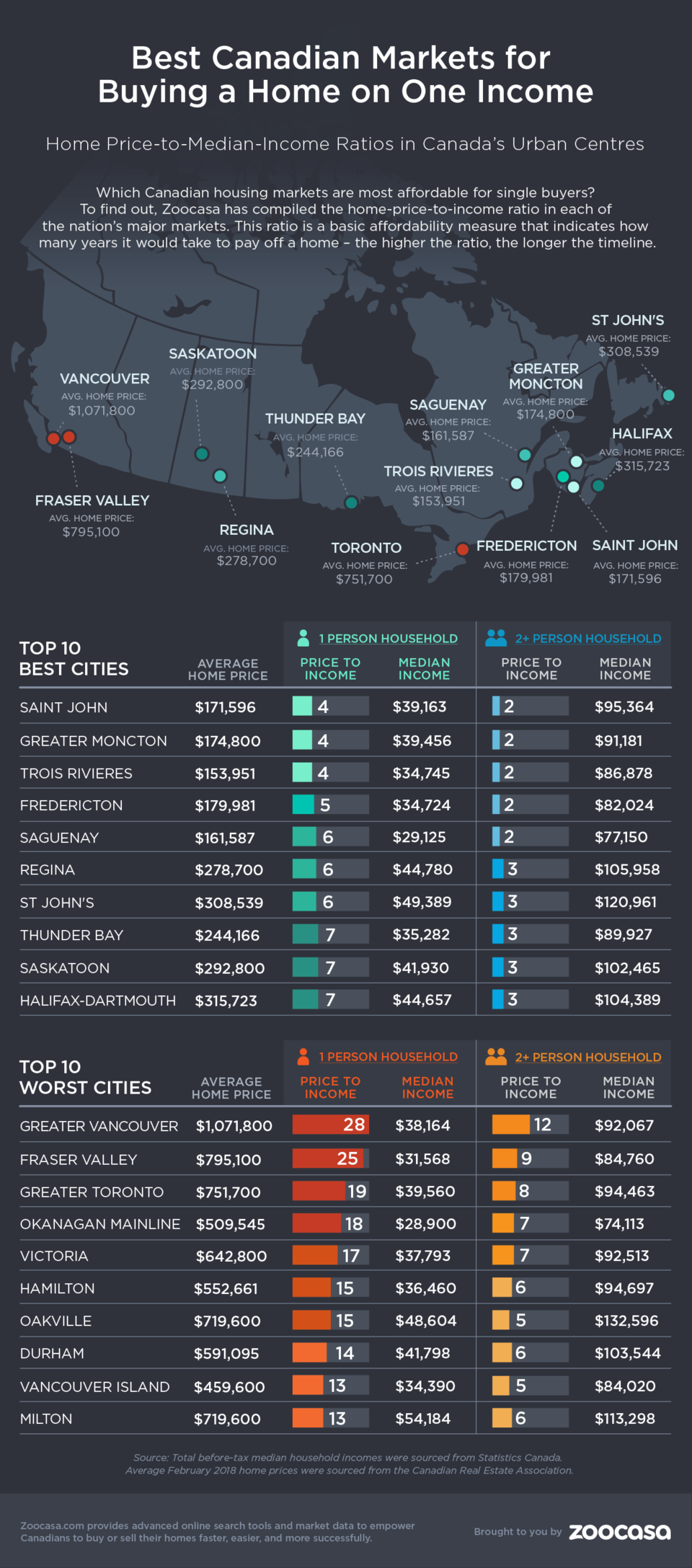

Canada is a hugely diverse country – and so are its real estate markets. The Lower Mainland and Greater Toronto are notoriously expensive, while some areas are still extremely affordable – even if you’re on a single-person income.

Real estate website Zoocasa compared median incomes for single-person households and compared those with the average price of a home in each city across Canada. From that, they calculated the “best” and “worst” cities to buy a home on a single income.

Some of the results are pretty obvious, but do you know where the most affordable places are? Check out Zoocasa’s infographic below to see where a single salary stretches furthest. It may also come as a surprise that the Fraser Valley was found to be less affordable than Toronto, because of lower median incomes.

The price-to-income ratio cited is the average home price in a city, divided by the Statistics Canada-cited median one-person income in the same city. This indicates how many years it would take to pay off a home if you bought an average-priced home and put 100 per cent of your median single-person salary towards it. (The ratio does not take into account any down payment or other equity in a home.)